AI Content Detection & Digital Media Forensics

Protect your organization against fraud and losses.

Reduce costs with automated photo, video, and document validation.

Boost your company reputation and monetize trust in your secure systems.

Safeguard Your Business Against Generative AI and Fake Digital Media

Current Challenges for Multiple Industries

Generative AI

Companies face the use of realistic but fake photos created to misinform or deceive people and organizations.

Automation

Organizations deserve stronger cost efficiencies and a better customer experience in the competitive automation industry.

Fraud protection

Many industries lack available automated and integrated processes designed to fight fraud.

Who uses Attestiv?

Build your business with the help of our trusted enterprise solutions

For use in personal property and commercial quoting, claims, renewals, inspections, and more

Prevent fraud and losses from fake and altered photos, videos and documents. Make IDP and documents automation tamper-proof

Build increased trust in image and video content with authentication and traceability.

Attestiv technology validates critical data for industries like IoT, Real Estate, Shipping, Automotive, Construction, and more.

We offer a suite of products and APIs designed to improve your business. We use our patented validation technology to enhance each of our offerings.

Protect Your Organization from Fraud, Disinformation, and Security Threats

Attestiv overview

Video length: 90 seconds

Digital Media Validation Platform

Protect against:

- Altered photos, videos, and documents that are increasingly easy to create but difficult to detect

- Fraud, disinformation, and security threats that now plague organizations and increase your economic and reputational risks

- Deepfake phishing attacks claiming to be you or a representative of your company

- Our sector-agnostic approach provides solutions, including photo analysis, workflows, and APIs

- Attestiv provides validation and authenticity for all photos, videos, and documents

Fingerprint Your Digital Assets with Attestiv

Safeguard and tamper-proof your digital assets

Identify fake and altered digital assets while protecting the integrity of your media

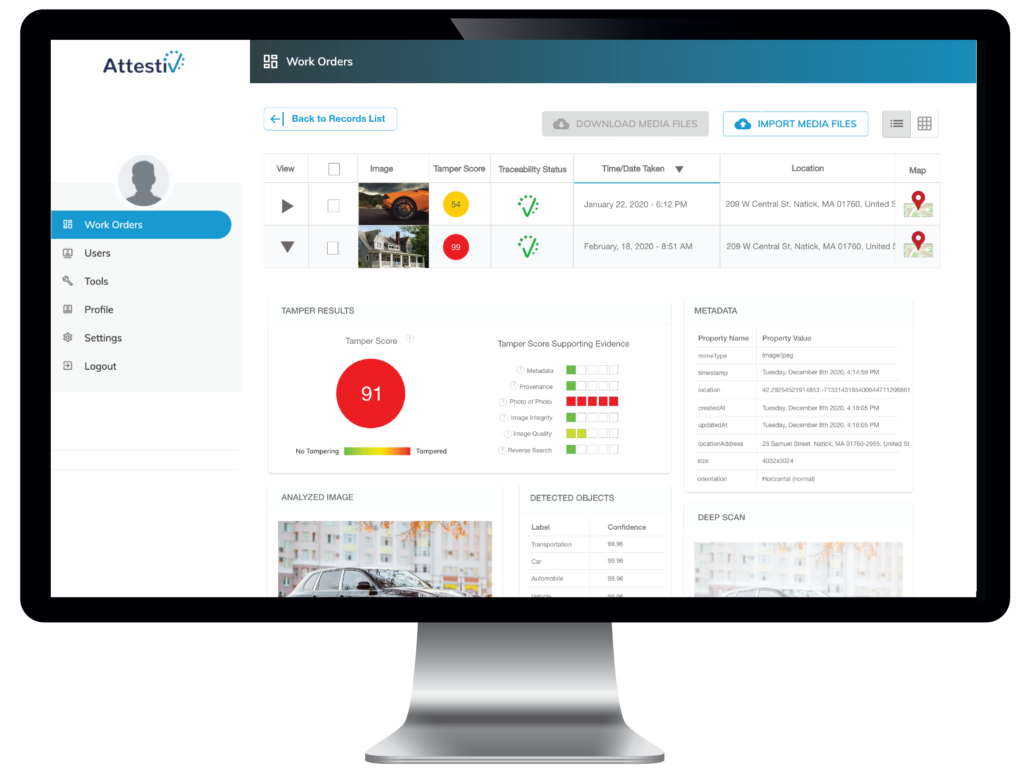

Attestiv validates the authenticity of any uploaded photos, videos, or documents your employees or customers provide. Using our patented AI technology, you and your customers can trust what’s real and know that any shared information is secure

Attestiv does not alter your digital assets. We fingerprint and validate them in real time via mobile devices, APIs, or the Attestiv web portal.

Enable Digital Transformation

We Offer Self-Service Solutions That Save Time and Improve Results

Guided workflows and authenticated images & videos enable your customers to document the condition of assets and provide you with essential details about your your business or organization.

Perfect for insurance and banking, automotive, construction industries and more.

Our services are designed to assist in the following industries:

More Efficiency, Less Fraud

Attestiv’s Groundbreaking Platform Provides Validation of Digital Assets and APIs for Insurance and Beyond

We help insurance organizations and other photo, video, and document-dependent industries meet their automation needs without exposing them to fraud.

Let Attestiv help you with quoting, claims, renewals, inspections, and more. We can prevent and detect fraud during customer photo and document submission and within multiple self-service operations.

Better Automation

Are You Making Critical Decisions Using Business-Quality Digital Assets?

If you use digital assets to make important decisions and enable trusted automation, let Attestiv analyze how you stack up against industry best practices for validating those digital assets.

Actionable insights gained with the help of Attestiv will help your organization improve, optimize, and protect the intake of digital assets, creating sustainable and fraud-resilient processes.

FAQs About Attestiv AI Detection Software

Helpie FAQ

- Can AI content be detected?

Indeed, it can. This is the reason Attestiv’s AI detection software was designed. Our program detects AI-generated content, including deepfakes and other forms of synthetic media, so you can ensure that your organization’s digital assets can be trusted as authentic.

- Can you trust AI detectors?

Attestiv’s AI detector program is built on advanced algorithms and meticulously tested machine learning techniques, on which we continuously strive to improve. Our mission is to provide reliable results and accurately detect fraudulent content. While no detection system is infallible, organizations worldwide trust our software for its accuracy and effectiveness.

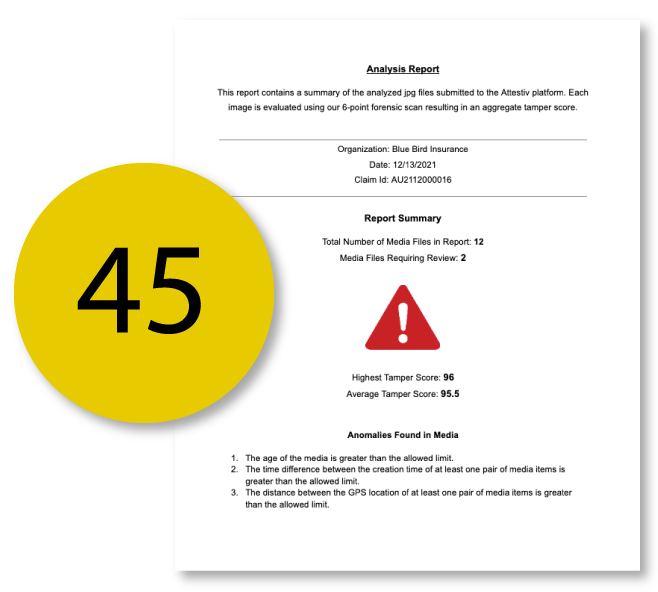

- How accurately can Attestiv detect fraud in photos, videos, and documents?

Attestiv uses a combination of rapid AI and rules-based models, validated against large data sets to score files and determine a probability for fraud. Every software program must consistently evolve to keep up with new fraudulent activities. Fortunately, thanks to its robust detection capabilities, the Attestiv platform has proven highly accurate in detecting fraud across various digital assets, including photos, videos, and documents.

- What types of manipulations can Attestiv identify?

Our AI detection software can identify a wide range of manipulations, including Photoshop edits, generative AI deepfakes, image splicing, content insertion, and document alterations. It is continually updated to keep pace with emerging manipulation techniques.

- How does Attestiv integrate with existing workflows?

Attestiv’s platform flawlessly integrates with existing workflows through APIs and SDKs, allowing for easy incorporation into various systems, such as insurance claims processing platforms. Our flexible integration options ensure minimal disruption to your operations.

- Is Attestiv easy to use for non-technical users?

Yes, the Attestiv software is designed with user-friendliness in mind. Our intuitive interface and straightforward processes make it accessible for users of all technical backgrounds.

- Does Attestiv offer different pricing plans for different needs?

Yes. We aim to accommodate organizations of all sizes by offering customized pricing plans tailored to our client’s needs. Whether you’re a small business or a large enterprise, we have flexible pricing options to suit your requirements.

- How long does it take to analyze a digital asset with Attestiv?

The analysis time varies depending on the complexity of the specific asset, but our unique software typically provides fast and efficient verification results.

- How does Attestiv ensure the security of uploaded data?

Data security is our priority! We employ robust encryption methods and secure data handling practices to safeguard all data uploaded throughout the verification process. Our program adheres to strict security measures and compliance standards to protect your assets against unauthorized access and data breaches.

- What happens if Attestiv misidentifies a genuine asset as fraudulent?

In the rare event of a misidentification, the Attestiv program provides mechanisms for users to report false positives. Our team promptly investigates these cases to take corrective actions and prevent any potential recurrence.

- What types of digital assets can be verified using Attestiv’s platform?

The Attestiv platform can verify various types of digital assets, including but not limited to photos, videos, documents, audio recordings, and other multimedia content.

- Can Attestiv’s software be customized to meet specific business needs?

Of course. We provide customization options to ensure we can meet your organization’s specific requirements. Our team will work closely with you (the client) to custom-build our software solutions for your company’s unique challenges and goals.

- Does Attestiv offer analytics or reporting features that track and analyze verified digital assets?

Absolutely. In the current world where digital assets are so valuable, it’s our responsibility to provide our customers with analytics and reporting features built to track and analyze verified digital assets. Doing so gives our users the insights they need to monitor their organization’s verification processes effectively.

Start protecting your business from fraud

Try it for free.

No strings attached.