Fact-check: Notification claiming ban on Saadat Hasan Manto’s writings is fake

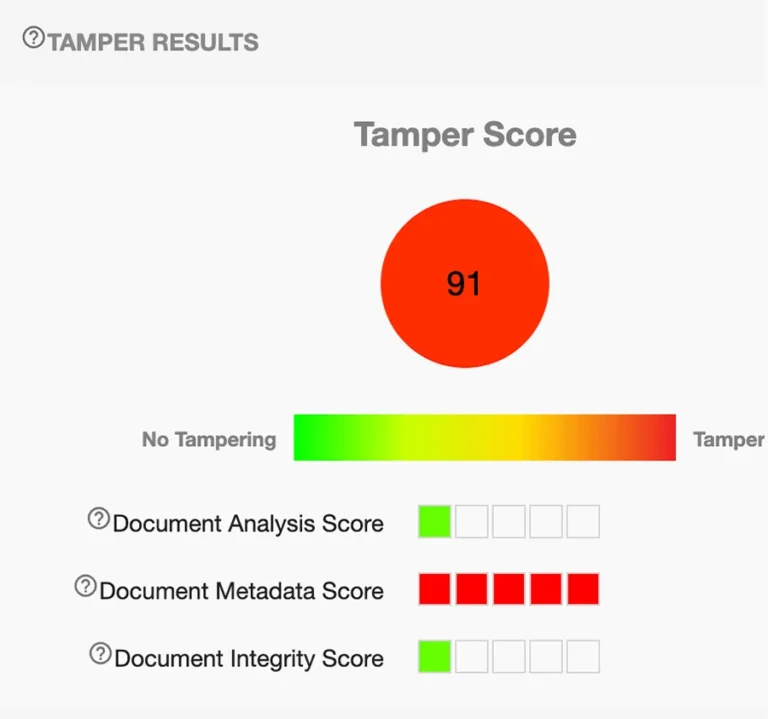

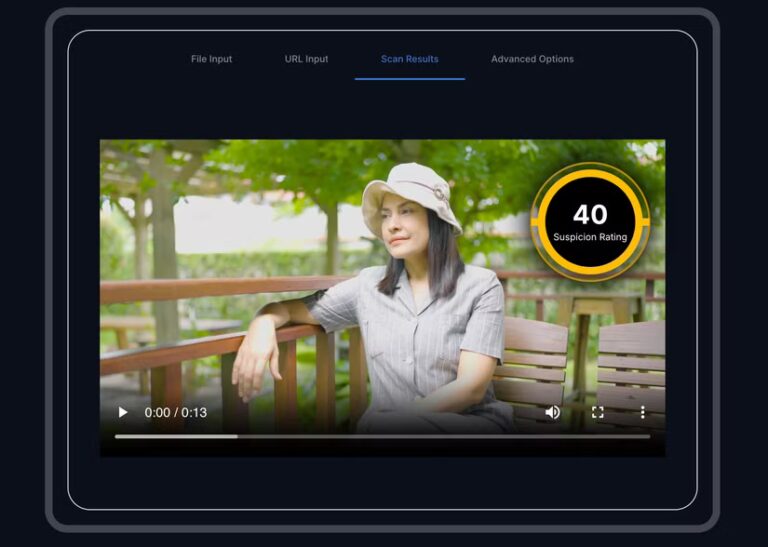

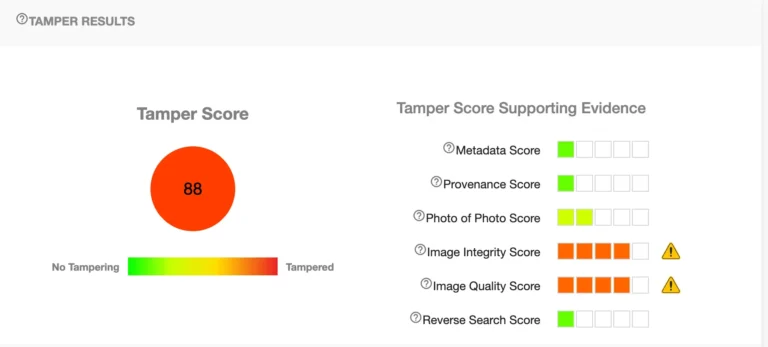

Attestiv document analysis indicates a high likelihood that the content is not authentic

Home > Digital media authenticity > Page 2

Attestiv document analysis indicates a high likelihood that the content is not authentic

Deepfakes and AI‑enabled deception pose serious challenges to insurance claims and digital trust

Attestiv chosen as one of the 4 most accessible and sophisticated tools for deepfake detection

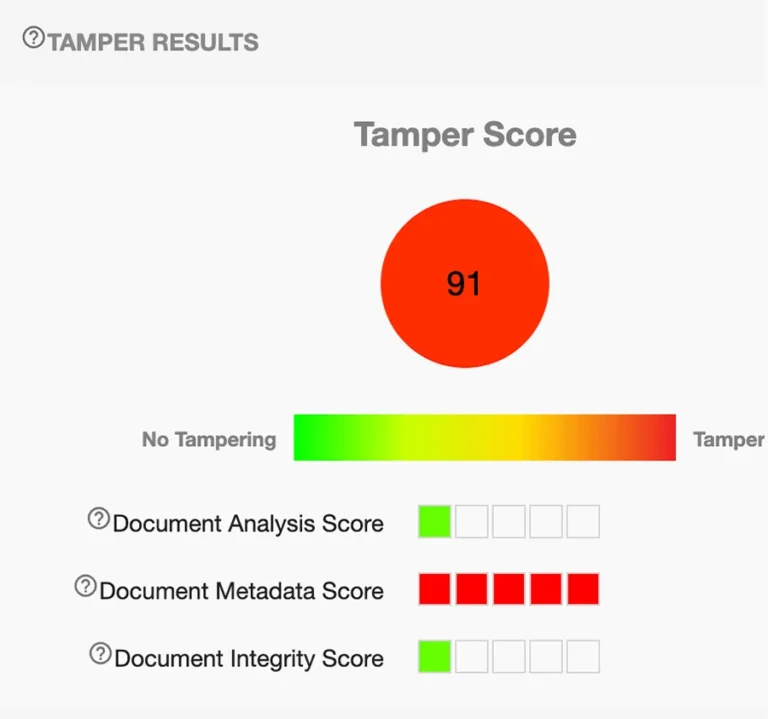

Both Attestiv and Hive Moderation found the video to not be authentic

Using Attestiv, a video claiming to show an Iranian missile hitting Tel Aviv was quickly exposed as AI-generated disinformation.

A recent Dark Reading article revealed how researchers used replay attacks to bypass leading deepfake detection systems. What does this mean for deepfake detectors?

Attestiv Video helps debunk another AI-generated politi-fake.

AI-generated impersonations are targeting everyday professionals — from job applicants and HR recruiters to financial advisors and insurance reps — and the consequences are both personal and business-critical.

New legislation imposes strict requirements on social media platforms and media publishers

As deepfake technology grows more sophisticated, businesses face an alarming rise in digital fraud and impersonation.

Mark Morley is the Chief Operating Officer of Attestiv.

He received his formative Data Integrity training at Deloitte. Served as the CFO of Iomega (NYSE), the international manufacturer of Zip storage devices, at the time, the second fastest-growing public company in the U.S.. He served as the CFO of Encore Computer (NASDAQ) as it grew from Revenue of $2 million to over $200 million. During “Desert Storm”, Mark was required to hold the highest U.S. and NATO clearances.

Mark authored a seminal article on Data Integrity online (Wall Street Journal Online). Additionally, he served as EVP, General Counsel and CFO at Digital Guardian, a high-growth cybersecurity company.

Earlier in his career, he worked at an independent insurance agency, Amica as a claims representative, and was the CEO of the captive insurance subsidiary of a NYSE company.

He obtained Bachelor (Economics) and Doctor of Law degrees from Boston College and is a graduate of Harvard Business School.