“Trust but Verify” was an old Russian proverb often quoted by President Ronald Reagan in the context of nuclear disarmament discussions with the Soviet Union. Later, Secretary of State John Kerry said “President Reagan’s old adage about ‘trust but verify’ is in need of an update. And we have committed here to a standard that says ‘verify and verify’.”

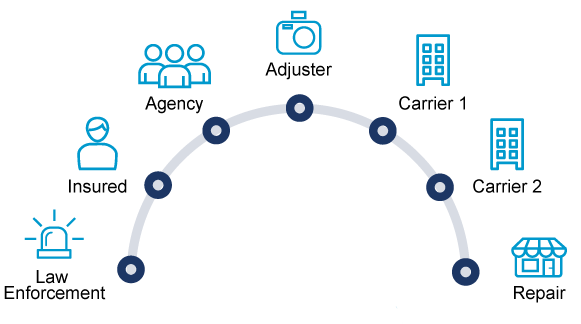

Insurance Stakeholders

One of the more notable aspects of the insurance ecosystem is the number of stakeholders that might be involved in any particular transaction. Certainly, there is the insured customer and an insurance carrier. Often there may be a second or third carrier in the case of a claim that involves multiple insured. Some customers may work through agents or brokers. Carriers may send adjusters to assess claims. Often, these are independent adjusters who are not direct employees of the carriers. Law enforcement and fire departments can be central to insurance claims. Finally, repair and restoration shops are critical to ensuring damage is repaired completely and properly so as not to create new risks going forward.

Creating trust with digital media

Each stakeholder may be gathering or holding important information regarding an insurance transaction, often in the form of digital media representing the condition of the insured asset in question. Maintaining trust that the assets are accurate across this entire ecosystem of stakeholders is no small feat, particularly with the understanding that fraud can originate from any stakeholder.

Digital photographs do have a place in insurance decisions, but only if we can “trust and verify” or, better yet, “verify and verify” them. While everyone knows the old adage “a picture can be worth a thousand words,” an altered digital picture can lead to thousands of dollars in fraudulent losses for an insurance claim. In a complex insurance ecosystem, the fraud may not only be difficult to detect but also difficult to pinpoint its origination.

To keep reading about digital media fraud and the impact within the insurance ecosystem, get our ebook on combatting digital photo and media fraud in insurance.