Recapping from the introduction of this 3-Part Series, Attestiv was recognized in the Plug-N-Play article “Top 10 Insurtech Companies in 2020” as an Insurtech “making promising changes in the industry.” The Attestiv technology is an Insurtech solution with “faster and cheaper claims processing, underwriting, and inspections.” Attestiv calls it the Trilemma –three ubiquitous industry challenges.

- Carrier – Reducing claims fraud

- Agency – Increasing Customer Self-Service speed

- Adjuster – Improving claims workflow simplicity

In our conversations up and down the insurance continuum, it seems that the key to solving the Trilemma is applying new technologies so that media assets are captured, transmitted, and stored using tamper-proof methods. For compliance reasons, these Agency stories are “hypothetical” so as not to violate confidentiality.

Recently, an executive with a $50M insurance agency reported that his firm is seeing explosive growth. Meanwhile, due to Covid-19, he’s shifting the business model away from in-person to video-based customer service for his 20-Agent team. The goals and objectives are the same – regular customer reviews to stay on top of changing risk profiles, and personalized service for claims, while at the same time growing the business with normal word-of-mouth referrals and prospecting.

Due to this shift from in-person to remote, there is a corresponding shift to customer self-service, something the insurance industry has been slowly adopting over the last 20 years since the dawn of the internet and e-Commerce. Covid-19 has certainly stepped hard on the customer self-service accelerator, hasn’t it? Thus, the need for a trust-worthy, tamper-proof, reliable, easy-to-use tool like the Attestiv Insurance Platform for quoting, underwriting, and claims.

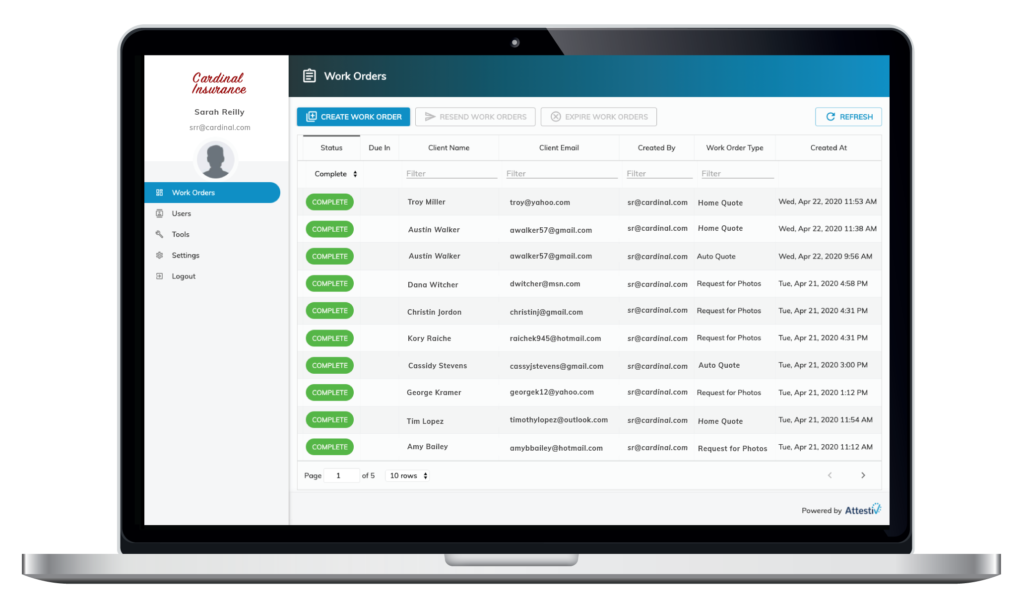

First, the Attestiv Insurance Platform allows for self-service quoting and claims submission via the agent’s website. Second, agents can now send specific self-service links directly to clients based on their needs. When the client opens the link on their smartphone, they will be guided through a request process, which could include capturing photos of the insured asset(s) and any corresponding documentation – titles, driver’s licenses, appraisals, inspection reports, registration, existing coverages, etc. This information is returned back to the agent’s Attestiv dashboard where agents can manage, track and take action on the provided information.

Compared to the legacy process, it’s easy to add up the savings in time, increases inaccuracy (which also saves time), and the virtual elimination of certain aspects of insurance fraud.

Once the customer has completed the requests, the process flows equally smoothly now that accurate, complete, tamper-proof, authenticated documentation is flowing in true digital fashion. The end result is that the property is insured faster and more accurately, and claims are paid faster and more accurately – all using remote processes that are perfect for a post-Covid-19 new normal, if one can call it that.

Just imagine the tremendous uptick in customer satisfaction scores, retention percentages, and resulting word-of-mouth referrals from a customer-base that is being served in this fashion. As the Agency executive said, “Never waste a crisis. We need to change the way we do things – for the better.”

Yes, there is a better way. Since 2018, we’ve been working hard to solve the Trilemma, combining blockchain, artificial intelligence, and API’s. And it’s working.

Meanwhile, we’re always interested in new ideas from the field. We’re just a phone call or email away. All boats rise with the tide. So, thanks for sharing.

Next up: Trilemma, Part 3 – Adjuster stories. The impact of tamper-proofing media from an Independent Adjuster point-of-view.