What is digital fingerprinting?

At Attestiv, we are able to secure data by fingerprinting each item to the blockchain to prevent potential inside and outside threats.

Home > Blockchain

At Attestiv, we are able to secure data by fingerprinting each item to the blockchain to prevent potential inside and outside threats.

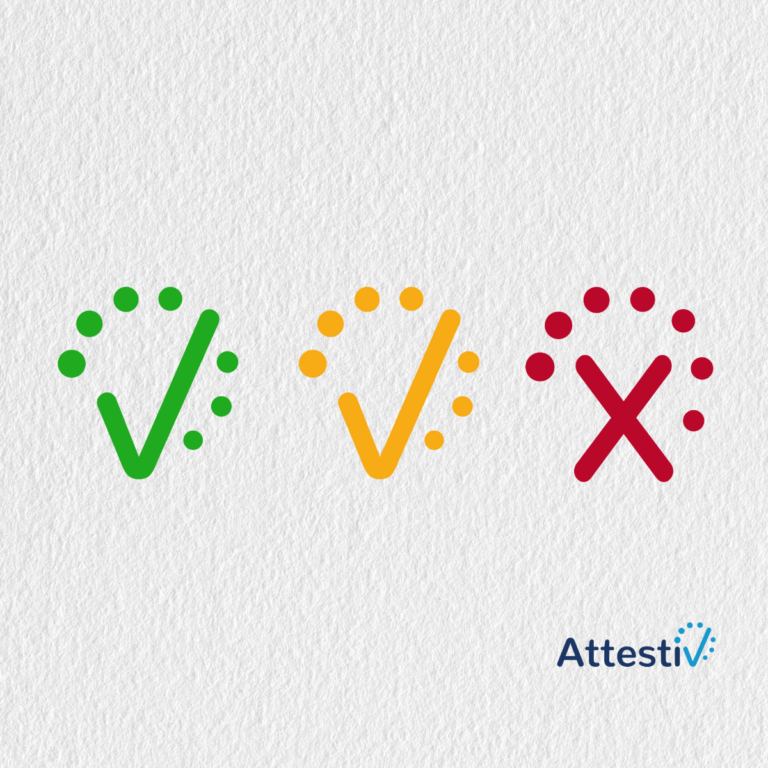

Goodness is hard to measure. More so in the field of Cybersecurity. In the physical world, if you possess something, say a $1 bill, you have it. If you spend it, you don’t have it. If someone steals it, you don’t have it, either. The digital world is quite different.

Companies like Attestiv, using the combination of AI and blockchain (or distributed ledger technology) have been able to carve a solid defense for organizations to put authenticity back into digital media.

Solving for insurance claims fraud and establishing an immutable baseline state of an underwritten asset is a primary application of Attestiv and blockchain technology.

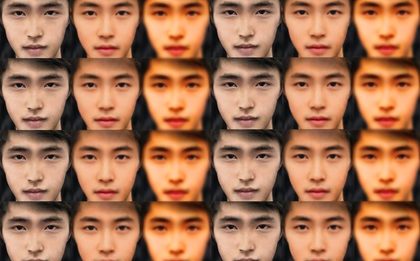

As deepfake videos become easier to produce, the age-old cliché of ‘seeing is believing’ has been fully upended. What can be done to ensure trust?

Blockchain elicits bifurcated views about its utility. Looking beyond cryptocurrency, are there use cases for blockchain in the enterprise?

Mark Morley is the Chief Operating Officer of Attestiv.

He received his formative Data Integrity training at Deloitte. Served as the CFO of Iomega (NYSE), the international manufacturer of Zip storage devices, at the time, the second fastest-growing public company in the U.S.. He served as the CFO of Encore Computer (NASDAQ) as it grew from Revenue of $2 million to over $200 million. During “Desert Storm”, Mark was required to hold the highest U.S. and NATO clearances.

Mark authored a seminal article on Data Integrity online (Wall Street Journal Online). Additionally, he served as EVP, General Counsel and CFO at Digital Guardian, a high-growth cybersecurity company.

Earlier in his career, he worked at an independent insurance agency, Amica as a claims representative, and was the CEO of the captive insurance subsidiary of a NYSE company.

He obtained Bachelor (Economics) and Doctor of Law degrees from Boston College and is a graduate of Harvard Business School.