In the past, staging a fraudulent auto claim required effort — faked police reports, staged accidents, or expensive props. But today, with the rise of AI-powered image generation, it’s shockingly easy for anyone to create fake car damage with just a few clicks. A dented bumper, a cracked windshield, even a smashed-in fender — all can be fabricated in seconds using deepfake technology with a simple text prompt.

For insurance carriers, that poses a major challenge. Fraudulent claims already cost the U.S. industry over $300 billion every year, and doctored photos only add fuel to the fire. When every smartphone owner suddenly has the ability to create photorealistic damage, the risks to carriers — and ultimately policyholders — rise dramatically.

The Deepfake Fraud Risk for Insurance

Ease of manipulation: Tools that were once limited to design professionals are now accessible to everyday consumers. Adding a dent to a vehicle photo is as easy as applying a filter.

Volume of claims: With more claims submitted digitally, insurers are increasingly reliant on photos and videos without direct inspection. That makes them a prime target for AI-generated fakes.

Evolving sophistication: Fraudsters are learning to bypass simple visual checks, creating damage that blends seamlessly with reflections, shadows, and metadata.

Why Detection Has Caught Up

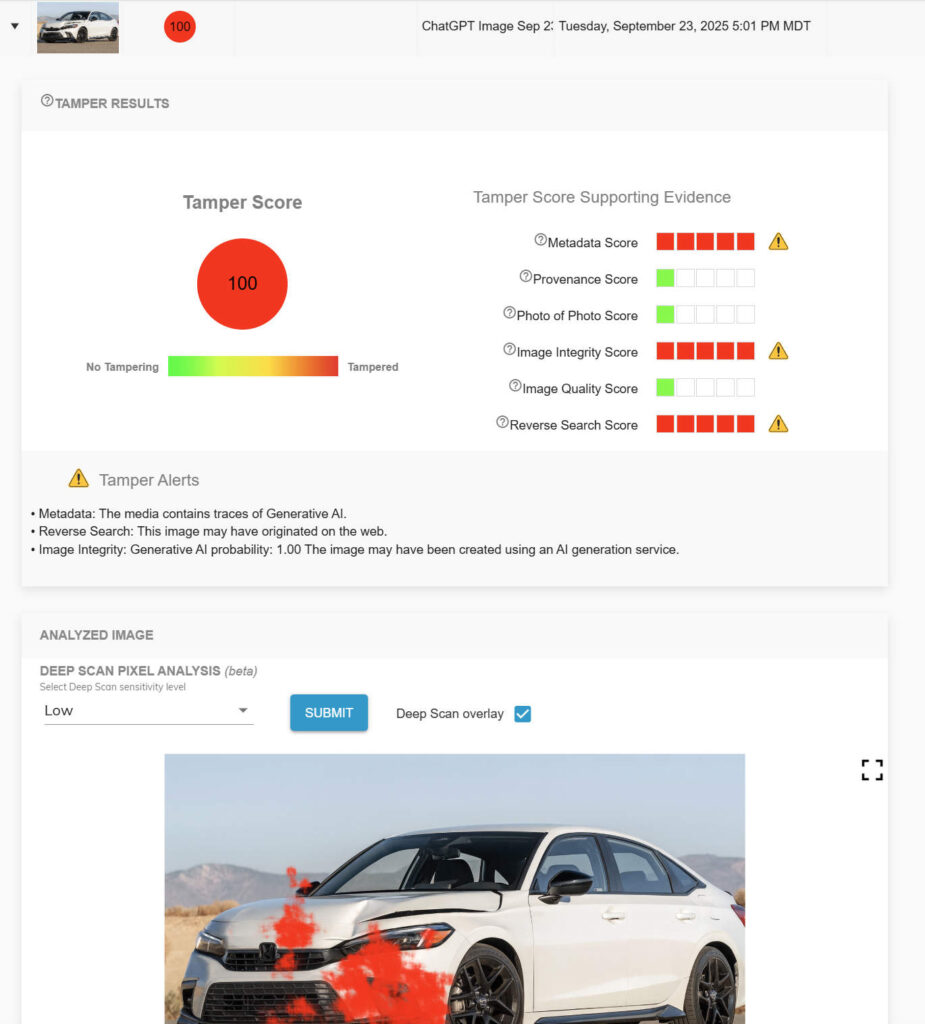

Fortunately, the same advancements that have enabled fake damage are also empowering insurers to fight back. Companies like Attestiv have developed AI-powered forensic tools that can detect when an image or video has been manipulated.

Attestiv’s platform analyzes every pixel, every compression artifact, and even the metadata behind an image. Within seconds, insurers can identify whether a photo of a dented hood is genuine or artificially generated. By integrating directly into claims workflows — whether through API or UI — this technology helps insurers:

Flag fraudulent claims instantly

Reduce manual review costs

Protect honest customers by keeping premiums in check

Turning a Threat Into an Opportunity

Deepfakes in auto claims are not just a passing concern — they are here to stay. But with robust detection tools, insurers can turn this threat into an opportunity: faster processing for legitimate claims, stronger fraud prevention, and improved trust with policyholders.

In a world where a dent may not be real, truth matters more than ever. With Attestiv, insurers can confidently separate fact from fiction and keep fraudsters from exploiting the system.